July 19, 2019

| Article | by REQ Marketing | Search Engine Optimization

The Impact of Events & Seasonality on Search Interest Around Las Vegas

If marketers pay attention to the predictable patterns of seasonality in their industry, then they can potentially mitigate the slumps and leverage the spikes. It’s no secret that many industries experience seasonality due to a variety of reasons such as weather, spring break, summer vacations, holidays, conventions, and more.

Tourism is probably the most obvious of those industries, and seasonality in tourism for any city directly impacts the hotel industry, the food and beverage industry, the entertainment industry, the retail industry, tour companies, the rideshare and taxi industry, city revenue from sales tax and/or alcohol and leisure taxes, and so on.

Las Vegas Tourism

Las Vegas is a convention capital, an entertainment mecca, a gambling center, and now a sports hub. It would be very difficult to overstate how much is riding on the city’s $60 billion a year tourism industry, such as the fact that 1 in 4 employed people in southern Nevada work in the tourism industry, or the fact that a billion dollars a year goes into the Nevada education system from revenues generated by various tourism-related taxes.

Fortunately, the “off” season is minimalized thanks to some 24,000 conventions hosted each year in the city, including several major conventions that each draw six-figures in attendees. And that’s not to mention major sporting events like the Super Bowl and March Madness which draw hordes of people annually to bet on the games, Electric Daisy Carnival, which attracts 400k+ attendees each year, two Nascar races per year, or National Finals Rodeo which takes place in Vegas every year and is a big draw thanks to more than a week of events and festivities.

Vegas Tourism Seasonality

Las Vegas’ tourism industry, however, does experience a significant amount of seasonality. Events such as those mentioned above, along with 3-day holiday weekends, serve as the primary catalysts behind increased visitor numbers, whereas the spaces in between where there’s nothing major going on, are where the dips in visitors occur. The purpose of this article is to look at how all of this influences related search interest on Google.

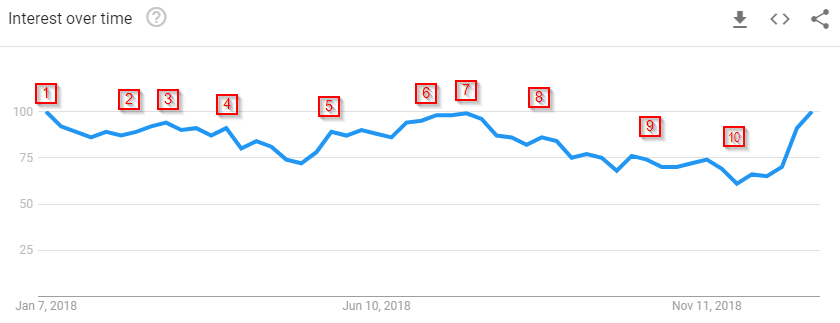

The chart below displays the search interest around “Las Vegas hotels” over the course of 2018. It’s a measurement of users performing searches on Google for that phrase and is relevant unto itself.

Source: Google Trends

The following annotations highlight the correlation between various events and their influence on search trends:

- New Year’s Eve followed by users searching for last-minute accommodations for CES (Consumer Electronics Show – draws nearly 200k attendees)

- Valentine’s Day – The Las Vegas Strip is the most visited tourist destination in the world for celebrating Valentine’s Day

- The Super Bowl is also a draw (the peak to the left of #2 was Super Bowl weekend)

- In 2018, partly on the back of the Magic Marketplace Spring show, February saw the largest total convention attendance of any month

- Thanks to March Madness, a busy convention calendar, a Nascar race, and spring breakers, March is the busiest month of the year for Las Vegas in terms of visitor volume

- April sees Vegas play host to a few large conventions including one for the National Assoc. of Broadcasters, which draws over 100,000 attendees

- Memorial Day weekend, which is one of the busiest weekends of the year for Las Vegas (and likely the busiest 3-day weekend)

- In 2018, June saw Vegas area hotels offer the second-lowest citywide ADR (average daily rate) of the year, and there were six different conventions that attracted at least 15k and as many as 39k attendees

- Independence Day, which is a significant draw

- Several large conventions, including Las Vegas Market, are held during the last few days of July and the first couple of days in August. Collectively, they drew well over 100k attendees in 2018

- Summer is rounded out with the Magic Marketplace Fall Show which draws 85k attendees, Labor Day weekend, and the second Nascar race of the year

- Halloween, which attracts a fair amount of visitors to Vegas despite the fact that October averaged as the second most expensive month of the year for hotel prices in 2018

- The peaks around this one represent Thanksgiving/Black Friday (users searching for travel deals more so than those interested in visiting on those days), and then National Finals Rodeo, which drew 169k people in 2018. The large upswing after that is leading back into New Year’s Eve

Capitalizing on Peaks

The key takeaway here is that any tourism-reliant brand in Las Vegas who is not ranking at or near the top of organic search results for relevant keywords, and whose digital strategy doesn’t include paid search ads, is missing out on significant year-round search interest. On the other hand, if a brand is ranking well organically for relevant keywords and/or they are running ads in Google and Bing, then they should be able to most-effectively capitalize on that interest.

Mitigating Slumps

For those who want to dig into tactical ideas, if one plans well in advance for these patterns, then ad budgets can potentially be spent more efficiently, as it can allow for a different, more tactical approach to digital strategy. For example, many area hotels put significant ad spends behind promoting offers around events such as March Madness and National Finals Rodeo, even though those rooms are very likely to sell anyway, based on the sheer volume of visitors for those occasions.

General offers that aren’t tied to such an occasion often seem to be an afterthought. Instead, one might want to utilize evergreen brand campaigns to stay top-of-mind for potential visitors for large events and focus on creating and advertising compelling offers for the periods in between these spikes in visitor volume.

Final Thoughts

Every month of the year offers something that attracts people en masse to Las Vegas, and it seems that the bulk of marketing budgets are spent on trying to compete for the visitors who come at peak times. There are many people who visit Las Vegas between those peak times, and little is spent on reaching them. This begs the question, are you better off spending your budget to compete with 50 others for a share of 200,000 visitors, or to compete with 5 others for a share of 150,000 visitors?

Sources:

- https://www.reviewjournal.com/business/tourism/las-vegas-tourism-spending-nearing-60-billion/

- https://assets.simpleviewcms.com/simpleview/image/upload/v1/clients/lasvegas/EIS_Economic_Impacts_FINAL_REVISED_3ab2ff2a-158b-4aa8-92d5-9f60772e3a98.pdf

- https://assets.simpleviewcms.com/simpleview/image/upload/v1/clients/lasvegas/EIS_Visitor_Contributions_to_Education_Nov_2018_Final_8e5be8c2-7451-47d0-98c1-b87ba9b453aa.pdf

- https://www.lvcva.com/stats-and-facts/visitor-statistics/

- https://news3lv.com/news/local/465000-expected-to-attend-this-weekends-electric-daisy-carnival

- https://www.vegasunzipped.com/crowded-vegas-strip-busiest-and-most-expensive-days-of-the-year/

- https://www.lvol.com/conventions/conv0119.html

- https://www.smartertravel.com/7-places-you-should-never-go-on-valentines-day/

- https://www.lvol.com/conventions/conv0218.html

- https://www.lvol.com/conventions/conv0418.html

- https://www.lvol.com/conventions/conv0618.html

- https://www.lvol.com/conventions/conv0718.html

- https://www.lvol.com/conventions/conv0818.html

- https://www.reviewjournal.com/sports/rodeo/national-finals-rodeo/2018-nfr-las-vegas-sees-bump-in-attendance-1553140/